Investment Firm Cypherpunk Holdings Sells All of Its Bitcoin and Ether

The publicly listed firm has transitioned its treasury to cash amid increased market volatility, but it hasn’t ruled out reinvesting in cryptocurrencies when the market settles down.

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/M6TIEEV3TZGELCIWPBH67VKNJE.png)

Canada-based investment firm Cypherpunk Holdings (HODL) has dumped all of its bitcoin and ether holdings to ride out the current market risks.

The company sold 205.8209 ether (ETH), the native token of Ethereum, for C$293,000 ($227,000) and 214.7203 bitcoin (BTC) for about C$6.09million ($4.7 million). It accrued a total of C$6.38million ($5 million) in proceeds from the sales, according to a Tuesday announcement.

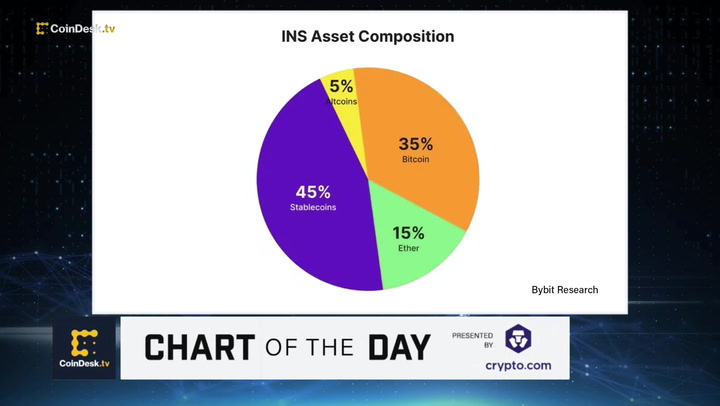

The company said it has C$18.16 million ($14.1 million) of cash and stablecoins on hand, adding it also has about C$1.93 million ($1.5 million) allocated to structured products with 30 days redemption notice.

Cypherpunk President and CEO Jeff Gao said the decision to dump all of the firm’s bitcoin and ether holdings came on the heels of rising market volatility that has made holding asset tokens increasingly risky for investors.

Both bitcoin and ether have lost more than half their value in the past year, sliding to 52-week lows earlier this month. The company's shares have tumbled 50% this year on the Canadian stock exchange.

“We believe that the most prudent approach is to sit on the sidelines as we wait for the volatility and illiquidity contagion to come to its logical conclusion,” said Gao in the statement. “On the balance of probabilities, we see weaker price action opening the way to lower levels to come as reports of the number of chains imposing 'temporary' suspension on withdrawals increases,” he added.

Gao noted that Cypherpunk will maintain a “long-term bullish outlook” on cryptocurrencies and will look to capitalize on future investment opportunities in the space “as and when they present.”

Crypto winter

Cryptocurrency markets have been plunged into a particularly icy crypto winter as investors react to decades-high inflation by selling off riskier assets, leading markets to recoil.

For example, bitcoin mining companies including Riot Blockchain (RIOT) and Bitfarms (BITF) collectively sold off more than 100% of their entire output in May as the value of bitcoin fell 45%, an analysis by Arcane Research found.

As economic headwinds continue to present solvency issues for cryptocurrency lenders and spur large industry-wide layoffs, investors are likely to continue selling off their cryptocurrency assets and move their money in what they perceive to be safer, less volatile stores of value, until the market is on the upswing.

Cypherpunk Holdings Chief Investment Officer Moe Adham said until the market takes a turn the risks for cryptocurrency investors remain “significant.”

"Crypto markets remain in a deep risk-off environment,” said Adham “There remains risk of further significant drawdowns in asset prices across the crypto sector,” he added.

/arc-photo-coindesk/arc2-prod/public/LXF2COBSKBCNHNRE3WTK2BZ7GE.png)

:format(jpg)/s3.amazonaws.com/arc-authors/coindesk/460a2b59-66ea-422e-950f-434792f9a7c9.png)